carbon tax benefits and disadvantages

Also reducing the use of paper and recycling many materials can help keep the. An ETS fixes the path of total emissions which is what matters for climate changev.

27 Main Pros Cons Of Carbon Taxes E C

However it is hard to apply to small emitters.

. The Benefits and Drawbacks of Carbon Offsets. Discuss the concept of Carbon Tax and assess the advantages and disadvantages that India is likely to face with the imposition of this tax. The carbon tax can be really expensive considering that the government would need a substantial amount of money for its implementation.

You can get out of a carbon tax by switching to renewable or alternative fuels for your. Less carbon in the atmosphere will reduce the greenhouse gas effect and lessen the impacts of. The advantages and disadvantages of cap and trade and carbon trading.

Whats worse if sufficient funds were not available at. Consumers can opt to use less electricity and save energy but taxes will not apply downstream. 14 Advantages and Disadvantages of Carbon Tax.

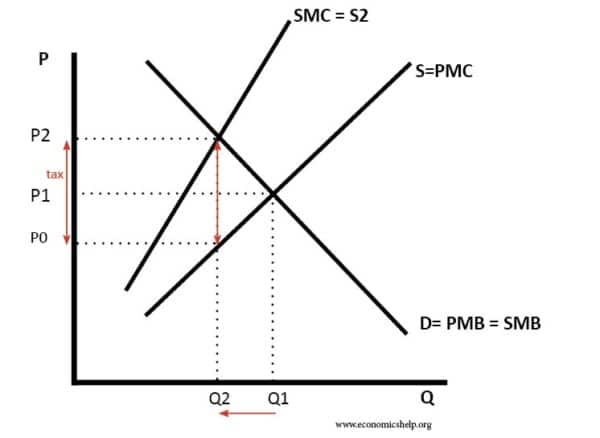

Using renewable fuel sources can reduce negative environmental impact. The market price is P1 but this ignores the external cost of pollution. A carbon tax might lead me to insulate my home or refrain from heating under-occupied rooms thus reducing emissions at a lower cost than by using expensive electricity generated from green sources.

Carbon sequestered is carbon not emitted into the atmosphere. Carbon offsetting has benefits at both ends of the process. The relevant tax-bases include energy products motor vehicles waste measured or estimated emissions and natural resources.

A carbon tax provides certainty about the price but little certainty about the amount of emissions reductions. The article consists of three parts. Does not fail as predictably snaps instead of bending I think it also has slightly lower compression strength putting limitations on its use for example requiring that you dont clamp it too tight in handlebars and posts.

One of the most common announcements one hears from companies looking to improve their environmental impact is the decision to become carbon neutral often through carbon offsets. A carbon tax would affect the price of fossil fuels and thus consumer prices both directly for fuels and indirectly for manufactured goods. Taxes are unrequited in the sense that benefits provided by government to taxpayers are not normally in proportion to the tax payments.

The first part will introduce the research question research methodology and explain cap-and-trade system and carbon tax. One of the advantages of using carbon tax is that it represents a quantifiable source of revenue generation that can be controlled by government along with providing an incentive to avoid the tax by reducing emissions. Tax revenue will fund transitional costs as well as.

A carbon tax can be very simple. Its an appealing idea but one that can be inordinately complicated as any company that has undergone this process can. The tax would help reduce US.

However there is a view that industrial units may shift to countries with lower or no carbon taxes. India is one of the most significant countries that have adopted a carbon tax over carbon pricing with Argentina and South Africa being the latest nations to place a tax under consideration. A carbon tax a fixed charge on each tonne of emissions.

Tax on carbon will induce firmsplants to push for green production processes in addition to raising revenue which can be used to promote environment-friendly initiatives. Effects of a Carbon Tax on the Economy and the Environment. A carbon tax is paid for by the people who use the fuel.

Adele Morris proposes a carbon tax as a new source of revenue that could also help address climate change. She suggests that a carbon tax would reduce the buildup of greenhouse gasses replace. It helps environmental projects that cant secure funding on their own and it gives businesses increased opportunity to reduce their carbon footprint.

And Dower and Zimmerman 1992 compare the merits of carbon taxes and tradable emissions permits. Higher fatigue strength error corrected Disadvantages. Advantages and disadvantages of going green.

Emitters can opt to improve energy efficiency and reduce emissions or pay taxes. Planting trees and managing their development is a proven way to reduce the number of harmful particulates in the air. When one use less or alternative energy one decreases their carbon footprint.

A carbon tax also has one key advantage. Summary of the advantages and disadvantages of a carbon tax. It is easier and quicker for governments to implement.

Carbon taxes will be applied upstream that is to direct emitters power stations etc. Assess When asked to Assess we must look into the topic content words in detail inspect it investigate it and establish the key facts and issues related to the topic in question. Carbon taxes have been suggested as a way to internalise the negative externality of carbon emissions.

In the second part the advantages and disadvantages of the cap-and-trade system and carbon tax will be analyzed by setting a counter-argument. When using combustion production companies emit carbon dioxide. Despite successful implementation of carbon taxes in Sweden they do not receive much attention as an alternative to emission trading systems in the international climate negotiations.

Studiesincluding those coming from carbon tax proponentscarbon taxes slow economic growth unless a large portion of the tax revenue is allocated to corporate tax reductions. Under either a carbon tax or a cap-and-trade program the desired result is a level of CO2 abatement which equates the cost of abatement. Like any other tax carbon taxes are a top-down policy instrument in which the nation state or an international regime would set a tax on CO2 emissions.

Advantages of Carbon Taxes. It imposes expensive administration costs. Cap-and-trade gives certainty on emissions reductions while a carbon tax.

Lawmakers could increase federal revenues and encourage. Emissions but would have only a modest effect on the Earths climate without a worldwide effort. The Pros of Carbon Offsetting.

The first carbon tax implemented by. A carbon taxs effect on the economy depends on how lawmakers would use revenues generated by the tax. Many companies cant reduce their emissions as much as theyd like to.

A carbon tax can have a positive effect on the local economy. For example a surcharge may be placed on every litre of petrol sold. A carbon tax of P2-P0 would raise the price to P2 and cause a more socially efficient level of output.

One advantage of a carbon tax would be higher emission reductions than from other policies at the same price. What are the advantages and disadvantages of Carbon Sequestration. List of Disadvantages of Carbon Tax 1.

14 Advantages And Disadvantages Of Carbon Tax Vittana Org

Carbon Tax What Are The Pros And Cons Climateaction

Carbon Tax Pros And Cons Economics Help

The Benefits And Disadvantages Of A New Tax Carbondigital

Advantages And Disadvantages Of Geothermal Energy Uses Benefits And Drawbacks Of Geothermal Energy A Plus To In 2021 Geothermal Energy Geothermal Potential Energy

Carbon Tax Pros And Cons Economics Help

V Model Advantages And Disadvantages What Is V Model When And How To Use It Merits And Demerits A Plus Topper In 2021 What Is Meant Dynamic Analysis Advantage